Many people don’t struggle to save money because they lack the desire to do so; instead, they often fail because they rely solely on willpower.

Each month begins with good intentions. You promise yourself that this time will be different. You plan to save what’s leftover, to “be more disciplined,” and to monitor your spending closely.

Then, life gets in the way. Bills come due, expenses accumulate, and temptations arise. By the time you check your balance, there’s nothing left to save.

Here’s the uncomfortable truth: manual saving is inherently flawed. It relies on constant decision-making in a world designed to drain your finances.

This is why individuals who automate their savings tend to save 73% more than those who attempt to do it manually. This isn’t because they earn more or are more intelligent, but because they eliminate human error from the process.

Let’s explore why automation is effective, why manual saving often fails, and how you can implement automation to achieve real financial progress.

Why Manual Saving Almost Always Fails

Manual saving sounds responsible. In theory, it gives you control. In reality, it creates friction.

Every time you save manually, you must:

-

Decide how much to save

-

Decide when to save

-

Decide what account to move it to

-

Resist spending it first

That’s four decisions — every single time.

Behavioral finance research shows that humans are terrible at repeated financial decisions, especially when emotions, stress, and uncertainty are involved. Decision fatigue sets in quickly, and saving becomes optional instead of automatic.

When saving feels optional, spending wins.

Manual saving also suffers from the “leftover money problem.” You save only what remains after spending — and there’s rarely anything left.

Automation flips this entirely.

The Psychology Behind Automated Saving

Automated saving works because it aligns with how humans actually behave, not how we wish we behaved.

Here’s what automation does psychologically:

1. It Removes Willpower From the Equation

Automation does not require monthly discipline. You make the decision once, and the system carries it out indefinitely. Saving becomes an effortless background process rather than a daily challenge.

2. It Uses “Pay Yourself First” by Default

Instead of saving what’s left after spending, automation saves before you ever see the money.

Your lifestyle adjusts around what remains, not the other way around.

3. It Reduces Emotional Spending

When savings are automatically moved out of sight, they’re no longer available for impulse purchases or emotional spending.

What you don’t see, you don’t spend.

4. It Builds Momentum Through Consistency

Small, automated amounts compound quickly. Consistency beats intensity every time.

Even $ 25-per-week automated beats $300 “when you remember.”

Why Automated Savers End Up With 73% More

The 73% figure isn’t magic — it’s math plus behavior.

Automated savers:

-

Save earlier, allowing more time for growth

-

Save consistently, avoiding skipped months

-

Save without friction, reducing drop-off

-

Increase savings gradually, without pain

Manual savers:

-

Skip months

-

Reduce contributions under stress

-

Forget entirely

-

Raid savings when money feels tight

Over time, automation quietly wins.

The difference compounds year after year, creating a massive wealth gap between people with similar incomes.

Automation Is Not About Saving More — It’s About Saving Smarter

One of the biggest myths about saving is that you need to start with a large amount.

You don’t.

Automation works best when it starts small and is scalable.

Examples:

-

$50 per paycheck to savings

-

5% of income automatically diverted

-

Round-up transactions are moved daily.

-

Weekly transfers instead of monthly

The goal is not to feel the pain — it’s to lock in consistency.

Once automated, you can increase contributions gradually as income rises or expenses fall. This is how savings grow without feeling restrictive.

The Best Accounts for Automated Savings

Automation is most effective when paired with the right accounts.

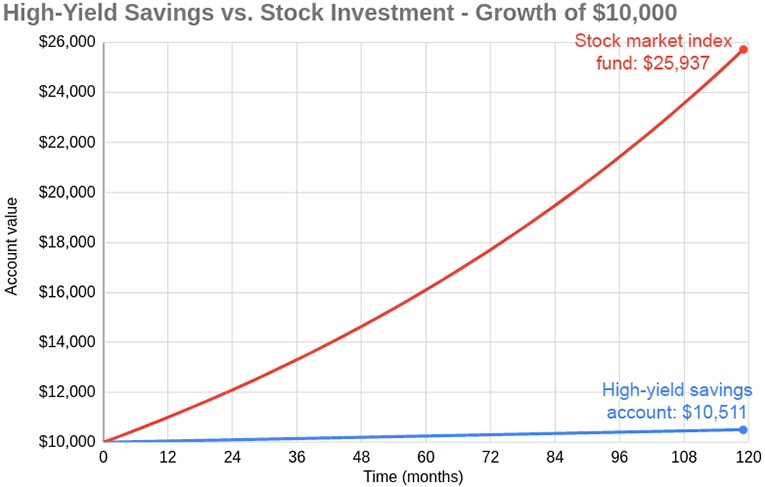

High-yield online savings accounts are ideal because they:

-

Earn significantly more interest than traditional banks

-

Support recurring transfers

-

Keep money separate from spending accounts

Separating savings from checking is critical. If your savings sit next to your spending money, automation loses its power.

The harder it is to access impulsively, the safer it becomes.

How to Set Up Automated Savings in 30 Minutes or Less

Here’s a simple framework anyone can follow:

Step 1: Choose a Dedicated Savings Account

Preferably one with a competitive interest rate and no minimum balance requirements.

Step 2: Decide on a Realistic Amount

Start with an amount that feels slightly uncomfortable — but not painful.

Consistency matters more than size.

Step 3: Match the Transfer to Your Pay Schedule

If you’re paid biweekly, automate biweekly.

If weekly, automate weekly.

The closer it aligns with income, the smoother it feels.

Step 4: Treat It Like a Bill

Once set, never pause it unless there’s a true emergency.

Savings is not optional. It’s non-negotiable.

Automation Protects You From Yourself

The biggest benefit of automation isn’t financial — it’s behavioral.

It protects you from:

-

Forgetting

-

Overspending

-

Lifestyle inflation

-

Emotional decisions

-

Short-term thinking

Automation builds wealth quietly, in the background, while you focus on living your life.

That’s why people who automate don’t just save more — they stress less.

Why This Matters More Than Ever

In a world of rising costs, unpredictable expenses, and constant financial noise, relying on discipline alone is a losing strategy.

Automation gives you:

-

Predictability in chaos

-

Progress without effort

-

Growth without stress

It’s not flashy.

It’s not exciting.

But it works.

And over time, it changes everything.

Final Thought: Systems Beat Motivation

Motivation fades. Systems endure.

If you’re serious about building savings — not just talking about it — automation is the line between hoping and actually winning.

People who automate their savings don’t think about saving more than others.

They designed a system that works even when they don’t feel like it.

And that’s why they end up with 73% more.

Leave a Reply