Category: Finance

-

Best Side Hustle Platforms (Top Apps & Websites to Earn Extra Income)

Side hustles aren’t just extra spending money anymore. In 2026, side hustles have become the new financial safety net — and in many cases, the path to full freedom. Whether you want to: pay off debt build savings replace a 9–5 start a business earn income online create long-term passive revenue The right platform makes…

-

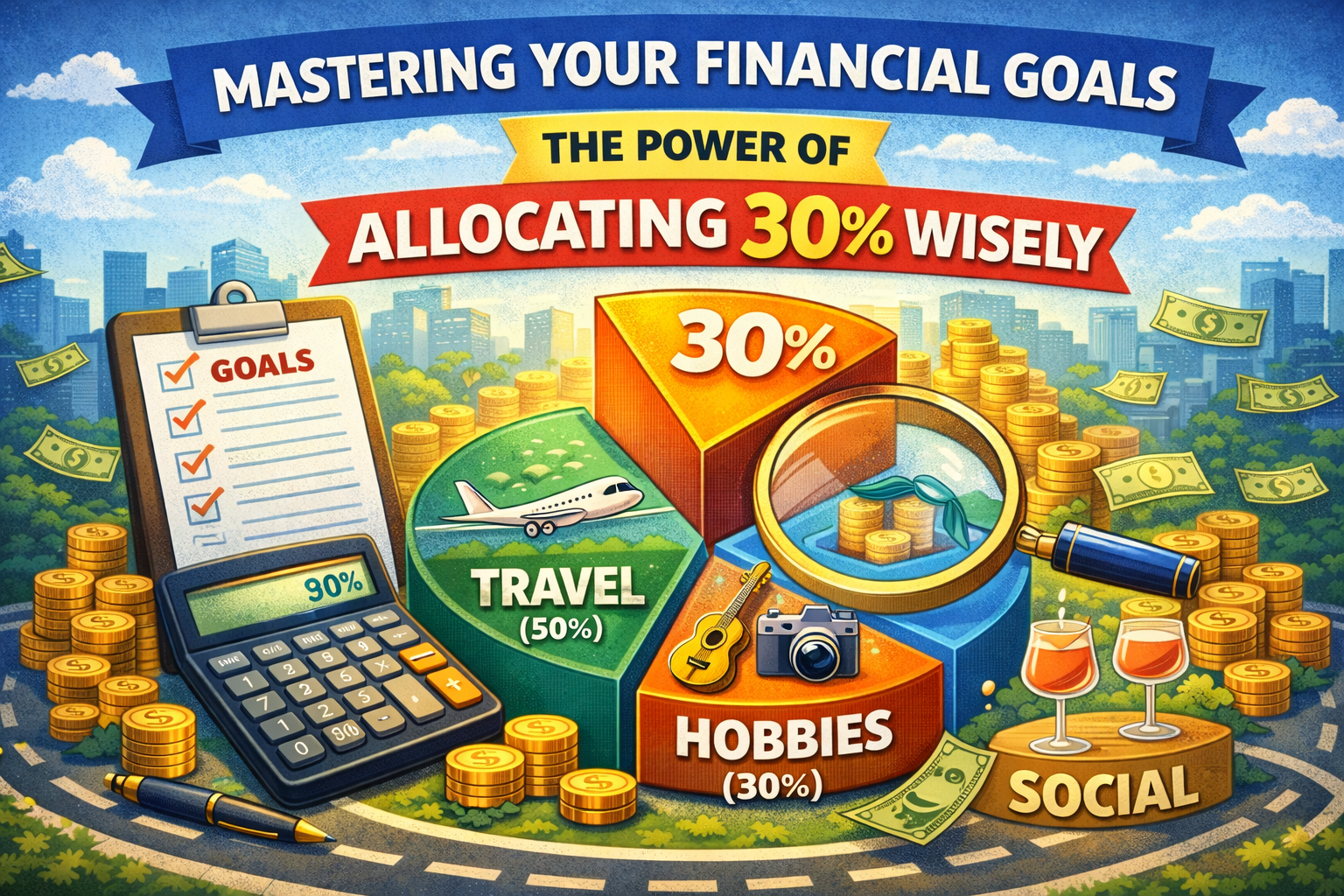

Mastering Your Financial Goals: The Power of Allocating 30% Wisely

Many people believe that financial success is primarily about saving more money. However, that’s not the case. It actually stems from spending wisely. You can have a high income and still feel financially strained, while someone with a modest income can steadily accumulate wealth. The key difference is not often the amount of money you…

-

Best Savings Platforms in 2026 (Top Apps to Grow Your Money Faster)

Saving money used to be simple. You opened a bank account, earned almost nothing in interest, and hoped you were doing enough. But in 2026? The smartest savers aren’t just using banks. They’re using modern savings platforms that help you: ✅ Earn 10–20x more interest✅ Automate deposits effortlessly✅ Separate savings goals visually✅ Track progress in…

-

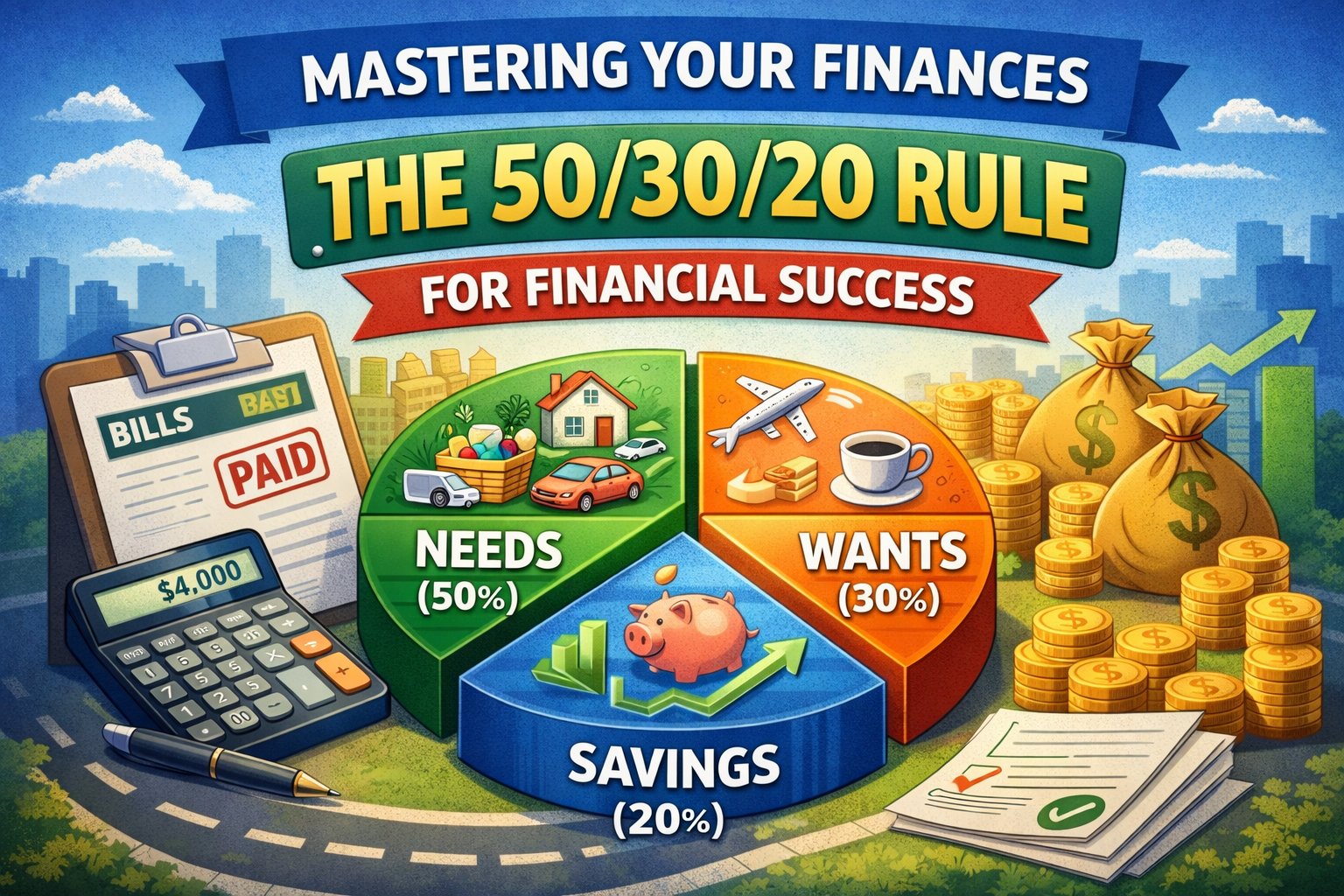

Mastering Your Finances: The 50/30/20 Rule for Financial Success

Most budgets fail for one simple reason: they rely on motivation. Many people track their expenses for two weeks, feel restricted by the process, and then stop. This isn’t due to a lack of discipline; rather, the system requires constant attention, which can be overwhelming. That’s why modern personal finance advice, especially from…

-

How to Protect Cash From Inflation (Without Locking It Away)

Inflation is one of the most overlooked threats to your financial progress. It doesn’t crash your bank account overnight.It doesn’t send an alert.It doesn’t look like a bill. But year after year, inflation quietly makes your cash worth less. If your money is sitting in a traditional savings account earning almost nothing, inflation is slowly…

-

Dealing with Setbacks: How to Stay Positive After Financial Mistakes

Financial setbacks can often feel overwhelming and disheartening, creating uncertainty. These challenges can arise from many sources, such as poor investment decisions, unexpected medical bills, sudden job loss, or even the temptation of overspending. Such money-related mistakes not only shake our confidence but can also significantly impact our overall financial stability, leading to stress and…

-

The Confidence Code: Building Financial Confidence

Financial confidence is the foundation of a secure and prosperous future. Yet, many individuals struggle with decision-making regarding their money due to fear, lack of knowledge, or past mistakes. In this guide, we will break down practical steps to help you take control of your financial decisions, build confidence, and create a pathway to long-term…

-

Automate Your Savings or Stay Broke

Many people don’t struggle to save money because they lack the desire to do so; instead, they often fail because they rely solely on willpower. Each month begins with good intentions. You promise yourself that this time will be different. You plan to save what’s leftover, to “be more disciplined,” and to monitor your spending…

-

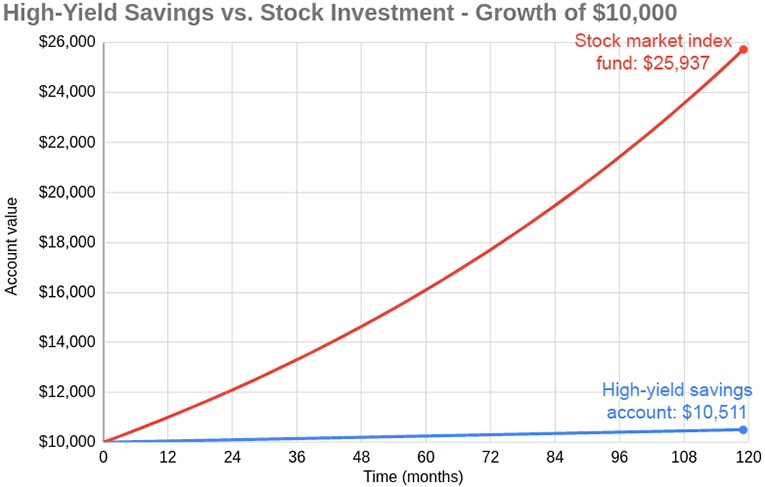

Why Don’t People Switch to High-Yield Savings Accounts?

If high-yield savings accounts (HYSAs) are objectively better than traditional savings accounts, why do so many people stick with the latter? It’s not because the numbers aren’t in their favor. It’s not that people don’t want higher interest rates. And it’s certainly not a bad idea to earn more on your savings. Most…

-

Why Most People Fail to Save (Even Though They Want To)

Almost everyone wants to save money. They talk about it, plan for it, and promise themselves they’ll start “next month.” Yet, year after year, their savings accounts barely change—or, worse, remain empty. This disconnect isn’t about intelligence, discipline, or desire; it’s about how saving is structured in most people’s lives. People don’t fail to save because…