Category: Personal Finance

-

Best Investment Apps in 2026 (Top Platforms to Grow Wealth From Your Phone)

Best Investment Apps in 2026 (Top Platforms to Grow Wealth From Your Phone) Investing used to be something only wealthy people did with financial advisors. But in 2026? Anyone with a smartphone can start investing in minutes. The challenge isn’t access anymore. The challenge is choosing the right platform. The best investment apps today make…

-

The First vs. Second Foundation of Personal Finance: What’s the Difference?

Personal finance is a journey, and like any journey, it requires a strong foundation. Many people focus on getting their financial house in order, but fewer understand the transition from financial stability to wealth-building. This is where the first and second foundations of personal finance come into play. In this guide, we’ll explore the key…

-

Best Debt Payoff Apps in 2026 (Top Tools to Get Out of Debt Faster)

Debt has a way of making life feel smaller. It limits your options, adds pressure to every paycheck, and turns financial goals into distant dreams. But here’s the good news: Paying off debt has never been easier than it is today — because the right apps can give you a proven system, structure, and motivation.…

-

Mastering Your Financial Goals: The Power of Allocating 30% Wisely

Many people believe that financial success is primarily about saving more money. However, that’s not the case. It actually stems from spending wisely. You can have a high income and still feel financially strained, while someone with a modest income can steadily accumulate wealth. The key difference is not often the amount of money you…

-

Best Savings Platforms in 2026 (Top Apps to Grow Your Money Faster)

Saving money used to be simple. You opened a bank account, earned almost nothing in interest, and hoped you were doing enough. But in 2026? The smartest savers aren’t just using banks. They’re using modern savings platforms that help you: ✅ Earn 10–20x more interest✅ Automate deposits effortlessly✅ Separate savings goals visually✅ Track progress in…

-

Mastering Your Finances: The 50/30/20 Rule for Financial Success

Most budgets fail for one simple reason: they rely on motivation. Many people track their expenses for two weeks, feel restricted by the process, and then stop. This isn’t due to a lack of discipline; rather, the system requires constant attention, which can be overwhelming. That’s why modern personal finance advice, especially from…

-

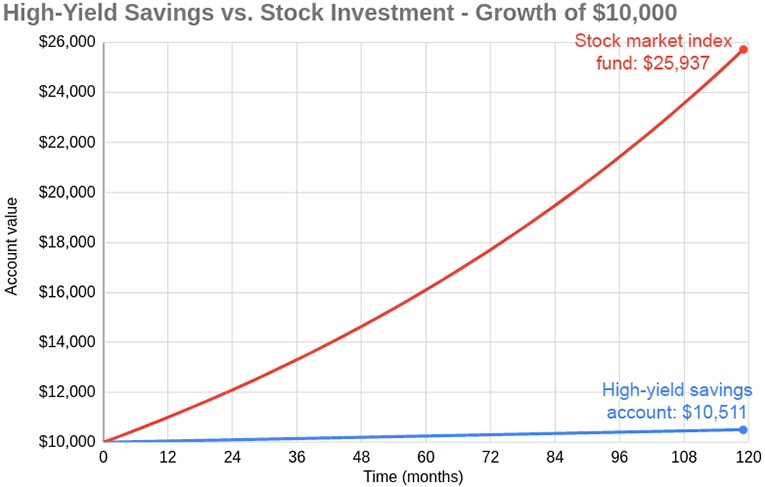

How to Protect Cash From Inflation (Without Locking It Away)

Inflation is one of the most overlooked threats to your financial progress. It doesn’t crash your bank account overnight.It doesn’t send an alert.It doesn’t look like a bill. But year after year, inflation quietly makes your cash worth less. If your money is sitting in a traditional savings account earning almost nothing, inflation is slowly…

-

Dealing with Setbacks: How to Stay Positive After Financial Mistakes

Financial setbacks can often feel overwhelming and disheartening, creating uncertainty. These challenges can arise from many sources, such as poor investment decisions, unexpected medical bills, sudden job loss, or even the temptation of overspending. Such money-related mistakes not only shake our confidence but can also significantly impact our overall financial stability, leading to stress and…

-

The Confidence Code: Building Financial Confidence

Financial confidence is the foundation of a secure and prosperous future. Yet, many individuals struggle with decision-making regarding their money due to fear, lack of knowledge, or past mistakes. In this guide, we will break down practical steps to help you take control of your financial decisions, build confidence, and create a pathway to long-term…

-

Automate Your Savings or Stay Broke

Many people don’t struggle to save money because they lack the desire to do so; instead, they often fail because they rely solely on willpower. Each month begins with good intentions. You promise yourself that this time will be different. You plan to save what’s leftover, to “be more disciplined,” and to monitor your spending…