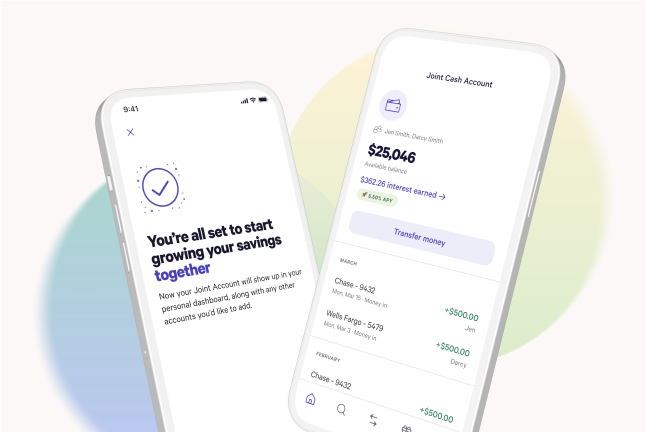

Managing joint finances can be challenging, especially for couples or partners who want equal access and control over their savings. Wealthfront has recognized this need and recently enhanced its Joint High-Yield Savings Account (HYSA), making it a standout choice in the realm of shared financial management.

This review will delve into Wealthfront’s Joint HYSA’s key features, explore recent updates, and analyze why it may be the ideal solution for those looking to grow their savings together.

Key Features of Wealth front’s Joint HYSA

Unique Logins for Each Owner: Enhanced Security and Independence

One significant update to Wealthfront’s Joint High-Yield Savings Account (HYSA) is the introduction of unique logins for each account owner. In traditional joint accounts, using shared credentials can raise security concerns and result in a lack of individual accountability.

Wealthfront has addressed this by allowing each partner to have their login, ensuring both can independently monitor and manage the account. This feature not only enhances security but also gives each owner the freedom to manage their finances according to their individual needs.

Full Access for Both Owners: Equal Control Over Shared Finances

Wealthfront’s Joint HYSA not only provides joint access, but also ensures that both account holders have equal control over all financial activities. Whether it’s making deposits, initiating transfers, or withdrawing funds, both owners have the same level of authority.

This equal footing is particularly beneficial for couples or partners who want to collaborate on financial goals, such as saving for a down payment, planning a vacation, or managing day-to-day expenses. The seamless integration of shared financial management with individual autonomy makes this account a powerful tool for co-managing money.

Boosted APY with Referrals: Maximizing Your Savings Potential

In today’s financial environment, where every percentage point counts, Wealthfront offers an attractive incentive to help you grow your savings faster. Through their referral program, both account owners can work together to boost their Annual Percentage Yield (APY) to a competitive 5.50%.

By successfully referring friends, family members, or colleagues to Wealthfront, you can take advantage of this high APY, one of the most appealing features of the Joint HYSA. This program encourages you to spread the word about Wealthfront and rewards you for doing so, making it easier to achieve your financial goals.

Upcoming Features: Preparing for the Future of Joint Banking

Wealthfront is dedicated to continually improving the user experience. They have announced new features that will be added to the Joint HYSA. Account holders can expect to receive account and routing numbers, which will simplify processes such as setting up direct deposits, linking external accounts, and managing payments.

Additionally, the ability to send and receive wire transfers will be introduced, providing greater flexibility and convenience for account management. These upcoming improvements will make Wealthfront’s Joint HYSA even more versatile and user-friendly, ensuring it meets its users’ evolving needs.

Why Choose Wealthfront’s Joint HYSA?

Wealthfront’s Joint HYSA is not just another savings account; it’s a thoughtfully designed product tailored to meet the needs of modern couples and partners. Here’s why it stands out:

1. Flexibility and Control:

The unique login feature allows both account owners to independently manage their shared finances, offering flexibility that few other joint accounts can match. Whether you’re splitting household expenses or saving for a shared goal, this account provides the control you need.

2. Security:

In an age where digital security is paramount, having individual logins adds an extra layer of protection. You can rest assured that your personal financial information is secure, even in a joint account.

3. High APY:

Wealthfront’s referral program is a game-changer, offering the potential to boost your APY to an impressive 5.50%. In comparison to other high-yield savings accounts, this is one of the most competitive rates available, especially when considering the ease of achieving it through referrals.

4. Future-Proof:

With additional features like account and routing numbers and wire transfer capabilities on the horizon, Wealthfront’s Joint HYSA is set to become even more comprehensive. These updates will make it easier to manage everyday finances while also planning for larger financial milestones..

Ideal Scenarios for Using Wealthfront’s Joint HYSA

The Wealthfront Joint High-Yield Savings Account (HYSA) is perfect for couples or partners who want to simplify their savings efforts. Here are some situations where this account excels:

1. Shared Savings Goals:

If you and your partner are working towards a major financial goal, such as buying a home or planning a wedding, Wealthfront’s Joint HYSA allows you to easily combine your resources and track your progress. Both partners have equal access and control, ensuring equal investment in the process.

2. Household Management:

Managing household finances can be challenging, especially when trying to balance multiple accounts and expenses. With Wealthfront’s Joint HYSA, you can consolidate your savings, making it easier to manage recurring costs such as rent, utilities, and groceries.

3. Emergency Fund:

Building an emergency fund is crucial, and doing so with a partner can make the process more manageable. The high APY offered by Wealthfront’s Joint HYSA ensures that your emergency savings grow faster, providing a financial safety net that both partners can rely on.

Final Thoughts

Wealthfront’s Joint High-Yield Savings Account is a forward-thinking solution designed to meet the needs of today’s financially savvy couples and partners. With its recent enhancements, including unique logins, full access for both owners, and the potential to boost your APY through referrals, this account offers a blend of flexibility, security, and growth potential that is hard to beat.

The upcoming features, such as account and routing numbers and wire transfer capabilities, promise to make this account even more versatile, ensuring it remains a top choice for those looking to manage their joint finances effectively.

Whether you’re just starting to save together or you’re looking for a more efficient way to manage your existing savings, Wealthfront’s Joint HYSA is a robust and reliable option that deserves your consideration. As Wealthfront continues to innovate and expand its offerings, this account will likely become even more valuable to its users, making it a smart choice for your financial future.

Start Maximizing Your Joint Savings Today!

Open a Wealthfront Joint High-Yield Savings Account and enjoy the flexibility, security, and growth potential you deserve. With unique logins, equal access, and a competitive APY of up to 5.50%, there’s no better time to take control of your shared financial future. Click below to get started and make every dollar count!

Leave a Reply