Tag: pay yourself first

-

Automate Your Savings or Stay Broke

Many people don’t struggle to save money because they lack the desire to do so; instead, they often fail because they rely solely on willpower. Each month begins with good intentions. You promise yourself that this time will be different. You plan to save what’s leftover, to “be more disciplined,” and to monitor your spending…

-

How to Automate Savings So You Never Have to Think About It Again

The easiest way to save more money is to remove yourself from the process If saving money ever feels like a constant battle between your goals and your spending habits, it’s not because you’re irresponsible. It’s because you’re human. Saving requires making a choice. Choices require energy. And when choices compete with convenience, urgency, or…

-

Automated Savings System

Turn saving from a conscious act into a built-in process that runs without your involvement. Real financial change doesn’t come from cutting costs, budgeting harder, or promising to do better next month. It comes from changing the way money moves in your accounts, so saving happens automatically before you have a chance to spend. This is the core…

-

The Smart Saver’s Blueprint

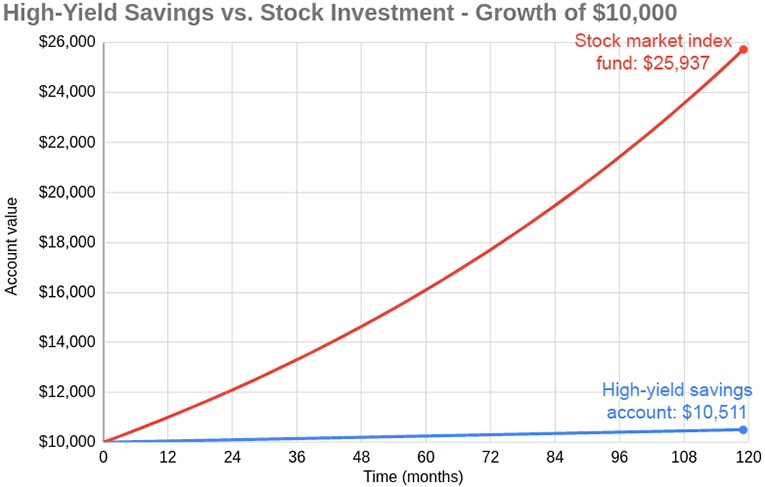

A strategic financial system to save automatically, grow consistently, and build wealth one behavioral shift at a time The #1 mistake people make with money isn’t overspending. It’s saving reactively instead of proactively. Most people save what’s left over after spending. Smart savers invert that logic and save before spending. They don’t depend on discipline…

-

What If You Treated Saving Money Like Paying a Bill?

Most people don’t struggle to save money because they don’t want to. They struggle because they treat saving as optional. Rent is non-negotiable. Car payment? You pay it on time. Phone bill? It gets paid before the late fee hits. But saving? That often gets squeezed into “if there’s anything left over…” Here’s the truth:…