Category: Budget

-

The First vs. Second Foundation of Personal Finance: What’s the Difference?

Personal finance is a journey, and like any journey, it requires a strong foundation. Many people focus on getting their financial house in order, but fewer understand the transition from financial stability to wealth-building. This is where the first and second foundations of personal finance come into play. In this guide, we’ll explore the key…

-

Best Debt Payoff Apps in 2026 (Top Tools to Get Out of Debt Faster)

Debt has a way of making life feel smaller. It limits your options, adds pressure to every paycheck, and turns financial goals into distant dreams. But here’s the good news: Paying off debt has never been easier than it is today — because the right apps can give you a proven system, structure, and motivation.…

-

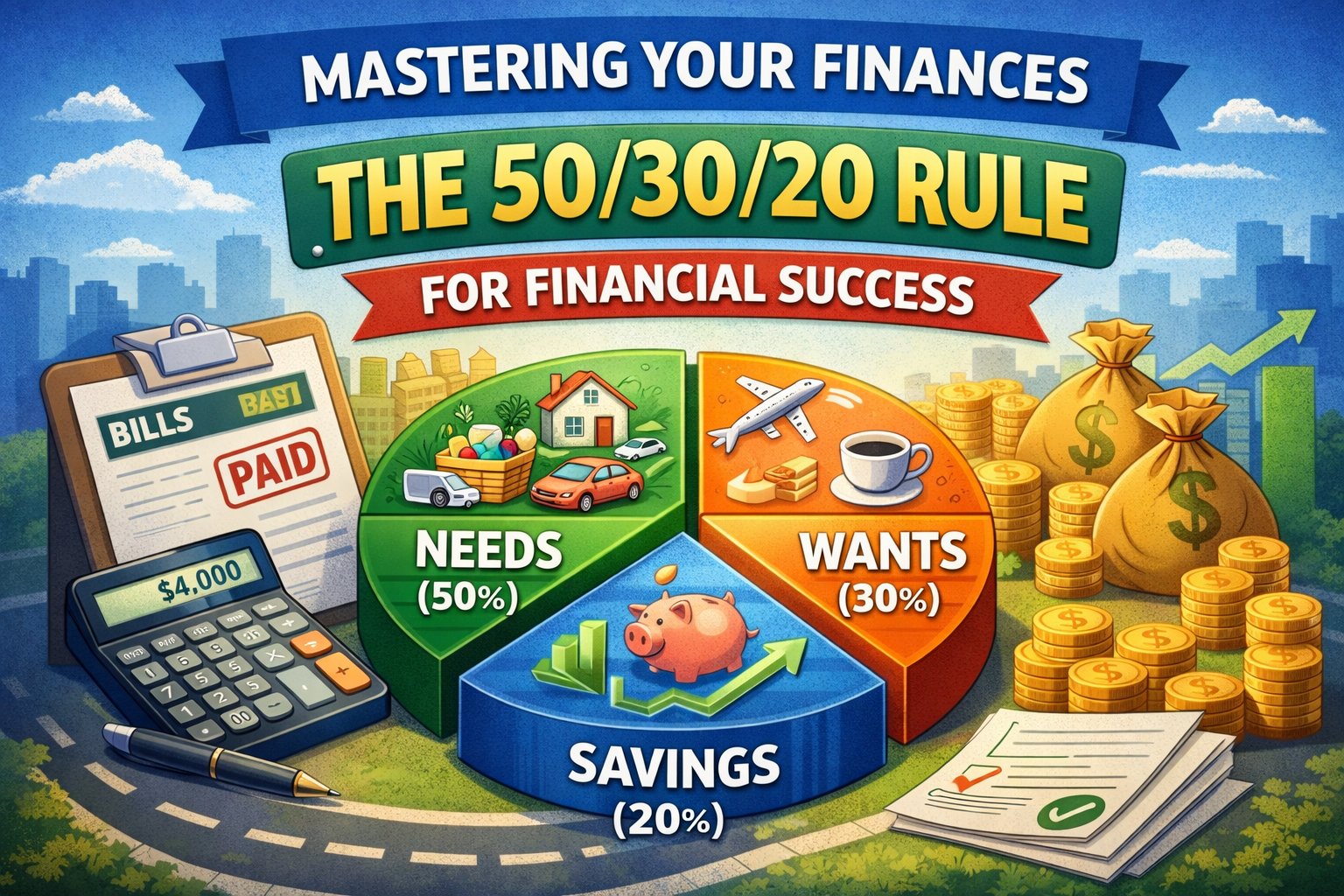

Mastering Your Finances: The 50/30/20 Rule for Financial Success

Most budgets fail for one simple reason: they rely on motivation. Many people track their expenses for two weeks, feel restricted by the process, and then stop. This isn’t due to a lack of discipline; rather, the system requires constant attention, which can be overwhelming. That’s why modern personal finance advice, especially from…

-

The Confidence Code: Building Financial Confidence

Financial confidence is the foundation of a secure and prosperous future. Yet, many individuals struggle with decision-making regarding their money due to fear, lack of knowledge, or past mistakes. In this guide, we will break down practical steps to help you take control of your financial decisions, build confidence, and create a pathway to long-term…

-

Why Most People Fail to Save (Even Though They Want To)

Almost everyone wants to save money. They talk about it, plan for it, and promise themselves they’ll start “next month.” Yet, year after year, their savings accounts barely change—or, worse, remain empty. This disconnect isn’t about intelligence, discipline, or desire; it’s about how saving is structured in most people’s lives. People don’t fail to save because…

-

Automated Savings System

Turn saving from a conscious act into a built-in process that runs without your involvement. Real financial change doesn’t come from cutting costs, budgeting harder, or promising to do better next month. It comes from changing the way money moves in your accounts, so saving happens automatically before you have a chance to spend. This is the core…

-

The Smart Saver’s Blueprint

A strategic financial system to save automatically, grow consistently, and build wealth one behavioral shift at a time The #1 mistake people make with money isn’t overspending. It’s saving reactively instead of proactively. Most people save what’s left over after spending. Smart savers invert that logic and save before spending. They don’t depend on discipline…

-

My $500 Savings Challenge

How a simple habit turned into passive earnings—no stress, no budgeting headaches, just one decision that changed everything Sometimes the most powerful financial change doesn’t start with a big leap. It starts with a small win. My journey began with a simple challenge: save $500—not to prove I could save, but to see if I…

-

What If You Treated Saving Money Like Paying a Bill?

Most people don’t struggle to save money because they don’t want to. They struggle because they treat saving as optional. Rent is non-negotiable. Car payment? You pay it on time. Phone bill? It gets paid before the late fee hits. But saving? That often gets squeezed into “if there’s anything left over…” Here’s the truth:…

-

The Best Strategies to Increase Your Savings Contributions and Build a Strong Financial Foundation

Consistently saving money is one of the most crucial steps toward achieving financial security and stability. By establishing a solid savings habit, you can prepare for unexpected expenses, work toward retirement, and set aside funds for important future goals such as buying a home, funding education, or starting a business. Whether you’re building an emergency…