As a small business owner, efficiently managing my finances is crucial. Opening a high-yield savings account (HYSA) with Wealthfront has been a game-changer, transforming my financial strategy and helping me maximize my savings.

I learned about HYSA in Ramit Sethi‘s book, and it has provided me with valuable insights into optimizing my saving strategies for my business.

Table of Contents

- What is a HYSA?

- Benefits of a HYSA

- My Wealthfront HYSA Results

- Automating Finances

- Dollar-Cost Averaging

- Future Growth

- Why Choose Wealthfront?

- Recommendation

What is a HYSA?

A high-yield savings account (HYSA) offers significantly higher interest rates than traditional savings accounts. This means that your money can grow faster while still providing the same security and liquidity as a regular savings account.

HYSA is an excellent option for individuals looking to maximize their savings and earn more from their deposited funds without taking on additional risk. With higher interest rates, your savings can work harder for you, helping you reach your financial goals more quickly.

Benefits of a HYSA

- Higher Interest Rates: Earn more on your savings with competitive APYs.

- Low Risk: FDIC-insured for peace of mind.

- Flexibility: Access your funds anytime without penalties.

My Wealthfront HYSA Results

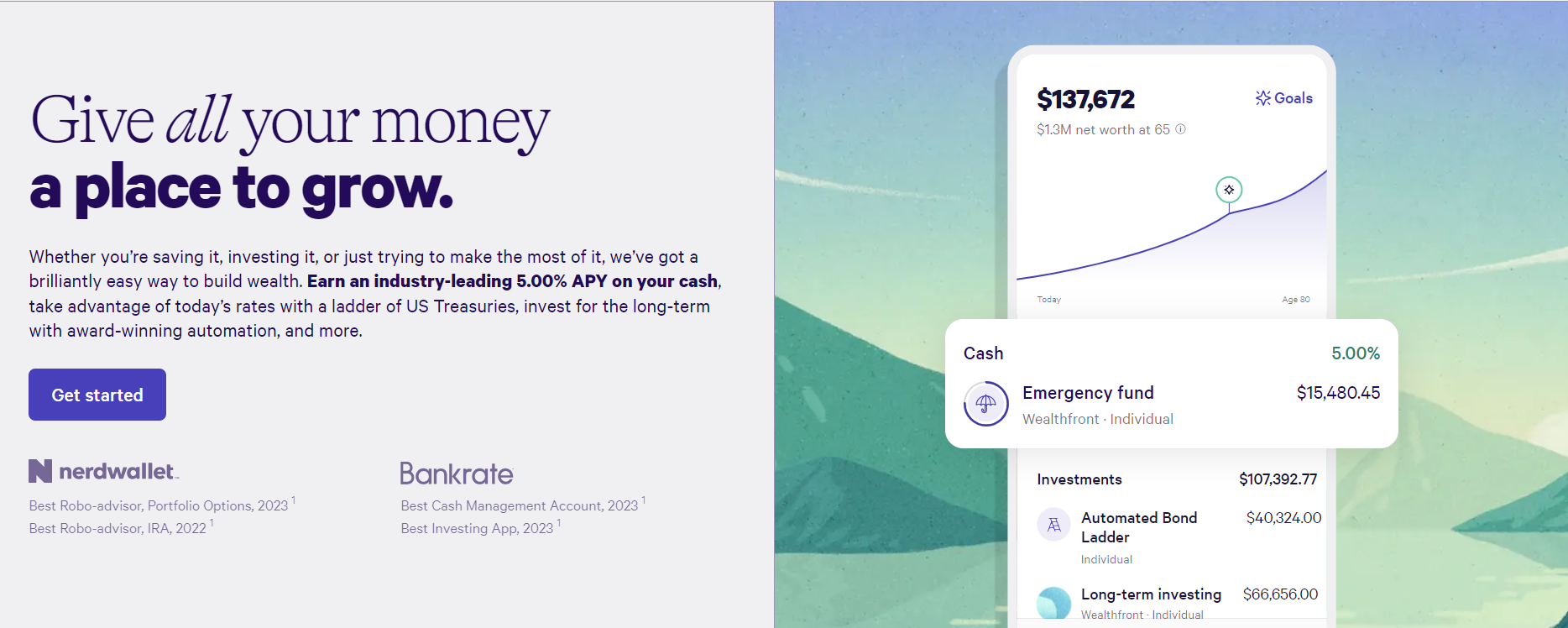

Over the past year, I have earned $895.80 in interest, with $837.80 already received and $58.00 pending. With a current APY of 5.00%, my savings are growing faster than I ever imagined. This substantial increase in interest is a testament to the benefits of a high-yield savings account.

Automating Finances

Wealthfront has genuinely revolutionized the way I manage my finances. By leveraging their intuitive platform, I have seamlessly automated my finances, making the process a breeze.

By setting up automatic transfers, I’ve safeguarded the consistent growth of my savings without manual intervention.

This level of automation perfectly aligns with the 50/30/20 rule that I adhere to, ensuring that my financial resources are allocated optimally for saving, spending, and investing. With Wealthfront, I’ve found a reliable partner to help me achieve my financial goals through innovative and efficient automation:

- 50% for essentials like rent, groceries, and utilities

- 30% for discretionary spending such as dining out, entertainment, and hobbies

- 20% into savings and investments

This approach has simplified my budgeting process and ensured that I consistently save and invest.

Dollar-Cost Averaging

One effective investment strategy I’ve been using is dollar-cost averaging. This approach involves regularly investing a fixed amount of money, regardless of market conditions. By doing so, I’ve been able to smooth out the impacts of market volatility and optimize the growth of my savings.

Dollar-cost averaging allows me to take advantage of fluctuating market conditions by purchasing more shares when prices are low and fewer when prices are high. This reduces the average cost of my investments over time, allowing me to grow my Wealthfront High-Yield Savings Account balance consistently.

I’ve found that this method provides a sense of discipline and helps me avoid making emotional investment decisions based on short-term market fluctuations. It has been a reliable way for me to increase my savings over time steadily, and I’ve seen the benefits of this strategy in my long-term financial planning.

Future Growth

The significant advantages I have gained make me incredibly optimistic about the future. Compound interest is truly remarkable because it ensures that my earnings will grow exponentially.

This demonstrates the immense power of putting your money to work for you. By reinvesting earned interest, I can harness the potential for compound growth, substantially boosting my savings over time.

It’s truly empowering to witness the long-term benefits of this approach to financial management.

Why Choose Wealthfront?

The Wealthfront platform is easy to use and provides various tools to help you manage and increase your savings. The feature to automatically make deposits and monitor my financial progress in real-time has been incredibly empowering.

Furthermore, Wealthfront offers personalized advice and insights that assist me in making informed decisions about my financial future.

Recommendation

I highly recommend opening a HYSA with Wealthfront to anyone looking to maximize their savings. It’s a simple yet powerful way to automate finances and achieve financial goals. The combination of high interest rates, automation, and strategic investing makes it ideal for anyone serious about growing their savings.

Don’t let your money sit idle. Take a step towards financial growth and stability by opening a high-yield savings account with Wealthfront today. You’ll start seeing the benefits.

Share this with anyone who could benefit from smarter savings and financial growth!

Leave a Reply