Investing is a powerful tool for growing your wealth and achieving your financial goals. However, many individuals find the world of investing daunting, filled with complexities and uncertainties.

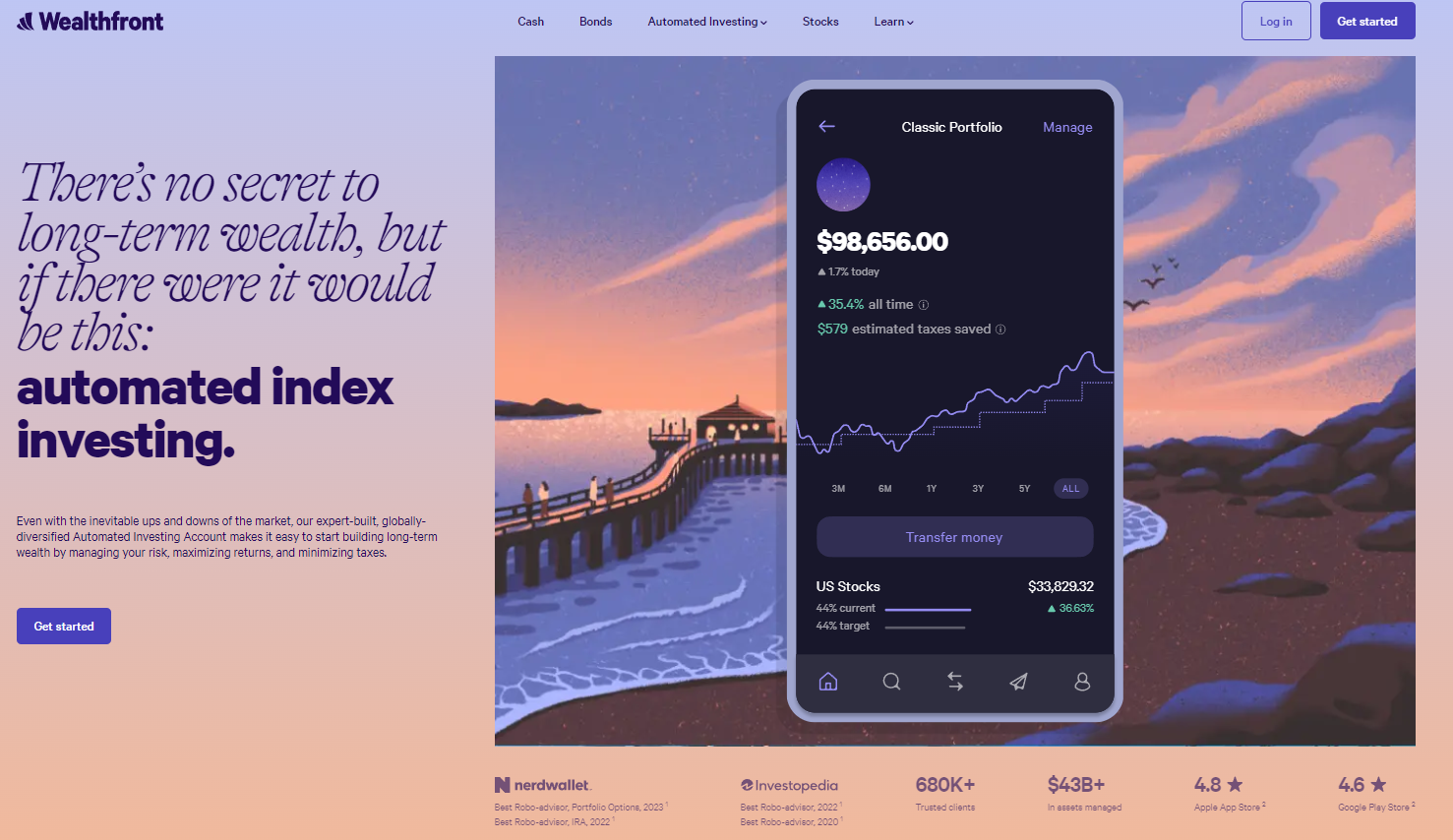

This is where Wealthfront’s individual investment account comes into play. Their automated platform simplifies the investment process, ensuring your money is invested wisely.

In this comprehensive blog post, we’ll explore how Wealthfront’s individual investment account can help you dive into the world of investing with confidence and clarity.

The Power of Investing

Investing is an important step towards building and preserving wealth. Wealthfront’s individual investment account presents an excellent option for you to consider. By investing, you can leverage your money to potentially generate returns that surpass inflation and traditional savings accounts.

Whether you’re saving for retirement, purchasing a home, financing your education, or pursuing any other financial goal, investing is a fundamental component of your financial strategy that demands attention.

Wealthfront’s Individual Investment Account: What Sets It Apart?

-

Automated Investing:

The platform at Wealthfront has been developed to make investing simple. It employs automated algorithms to create a diverse portfolio that is tailored to meet your specific individual financial goals and risk tolerance. This approach eliminates the need for guesswork and guarantees that your money is being utilized effectively to achieve your desired outcomes.

The platform at Wealthfront has been developed to make investing simple. It employs automated algorithms to create a diverse portfolio that is tailored to meet your specific individual financial goals and risk tolerance. This approach eliminates the need for guesswork and guarantees that your money is being utilized effectively to achieve your desired outcomes. -

Diversification:

One strategy for mitigating investment risk is to diversify your portfolio across multiple asset classes. Wealthfront’s platform provides this service by allocating investments across various asset classes such as stocks, bonds, and others. By doing so, the impact of volatility in any one asset is minimized, leading to a decrease in overall risk and an increase in the probability of long-term investment success.

One strategy for mitigating investment risk is to diversify your portfolio across multiple asset classes. Wealthfront’s platform provides this service by allocating investments across various asset classes such as stocks, bonds, and others. By doing so, the impact of volatility in any one asset is minimized, leading to a decrease in overall risk and an increase in the probability of long-term investment success. -

Tax Efficiency: Wealthfront employs tax-efficient strategies to optimize your after-tax returns. Their platform includes features like tax-loss harvesting and direct indexing, which can potentially increase your after-tax returns over time.

-

Customization:

Wealthfront’s platform leverages the power of automation, enabling hassle-free and efficient investment management. Nevertheless, the platform also offers diverse customization options to tailor investment strategies to specific circumstances and objectives.

Wealthfront’s platform leverages the power of automation, enabling hassle-free and efficient investment management. Nevertheless, the platform also offers diverse customization options to tailor investment strategies to specific circumstances and objectives.

You can set financial goals based on your desired outcomes and unique preferences. Whether it’s saving for a house’s down payment, planning for retirement, or building wealth in the long term, Wealthfront can help you achieve your goals.

Moreover, you can specify your risk preferences, which determine the investment types included in your portfolio. This ensures that your investments align with your risk tolerance and helps you achieve desired returns while minimizing potential downside risks.

5. User-Friendly Interface: Wealthfront’s user-friendly interface makes it easy to track your investments, monitor progress, and make adjustments when necessary. You can access your account through their website or mobile app, giving you control over your investments at your fingertips

6. Low Fees:  When it comes to managing your investments, it’s essential to consider transparency and cost efficiency. Wealthfront stands out as a reliable investment management platform that offers a fee structure that is both transparent and competitive. Rather than a flat fee, the annual advisory fee they charge is based on your account balance, making their fee structure fair and tailored to your investment portfolio.

When it comes to managing your investments, it’s essential to consider transparency and cost efficiency. Wealthfront stands out as a reliable investment management platform that offers a fee structure that is both transparent and competitive. Rather than a flat fee, the annual advisory fee they charge is based on your account balance, making their fee structure fair and tailored to your investment portfolio.

Moreover, Wealthfront doesn’t charge any trading commissions or hidden costs, which can accumulate and reduce your investment returns over time. Having no hidden fees means that more of your returns stay in your pocket, allowing you to grow your wealth and achieve your financial goals faster. Overall, Wealthfront’s fee structure is clear, simple, and designed to help you get the most out of your investments.

Getting Started with Wealth front’s Individual Investment Account

-

Setting Financial Goals: The first step is to define your financial goals. Are you saving for retirement, a major purchase, or simply looking to grow your wealth? Wealthfront’s platform allows you to specify your objectives to create a customized investment strategy.

-

Risk Assessment: Assess your risk tolerance by answering a series of questions. This helps Wealthfront determine the right asset allocation for your portfolio, balancing potential returns with your comfort level.

-

Account Funding: Fund your individual investment account by linking your bank account. You can set up automatic contributions for consistent investing.

-

Monitoring and Adjusting: Wealthfront’s platform automatically rebalances your portfolio to maintain your desired asset allocation. However, it’s essential to periodically review your account to ensure it aligns with your evolving financial goals.

Conclusion: Unlocking the Benefits of Automated Investing

Investing can present challenges and uncertainties, but Wealthfront’s individual investment account provides an accessible and straightforward approach to navigating the market.

Their automated, diversified, and tax-efficient strategies offer a hassle-free way to grow your wealth. By leveraging technology, Wealthfront provides confidence as you embark on your investment journey.

You can trust that your money is in capable hands, diligently working to help you achieve your financial goals.

With Wealthfront’s individual investment account, you can take control of your financial future with ease and dive into the world of investing.

Leave a Reply