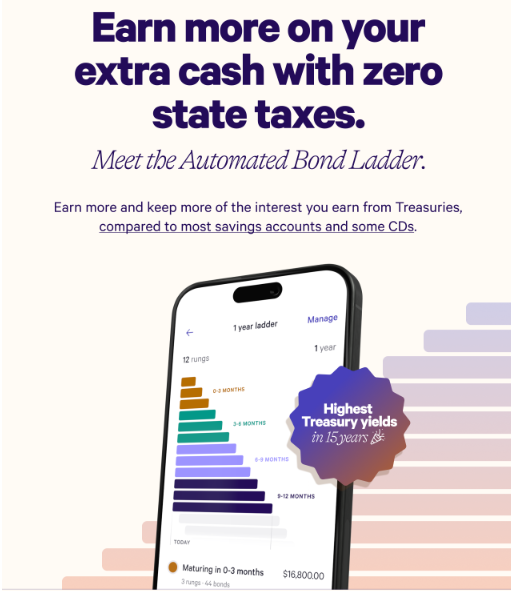

Wealthfront’s recent introduction of the Automated Bond Ladder has created quite a buzz in the investment community. This innovative product is tailored for investors seeking stable returns with minimal risk.

With the current trend of the best savings accounts paying 5% APY, the Automated Bond Ladder could be a game-changer for those looking to diversify their portfolio beyond traditional savings accounts and CDs. This development gives people more options for earning yield on their cash, which is especially appealing given the low interest rates on many traditional savings products.

Wealthfront’s reputation as one of TDI’s top robo-advisors further adds to the credibility and reliability of this new product. This endorsement from a respected source in the financial industry will likely instill confidence in potential investors considering incorporating the Automated Bond Ladder into their investment strategy.

What is an Automated Bond Ladder?

The bond ladder strategy involves investing in bonds with staggered maturity dates. This strategy involves purchasing bonds with different maturity dates, such as one-year, two-year, and three-year. As each bond matures, the principal is reinvested into a new bond with the most extended maturity date on the ladder.

This approach allows investors to maintain a consistent income stream while mitigating interest rate risk, as the staggered maturities help spread out the impact of interest rate fluctuations.

Wealthfront offers an automated version of the bond ladder strategy, simplifying the entire process for investors. By utilizing Wealthfront’s platform, investors can delegate the management of buying, selling, and reinvesting of bonds to the automated system.

This automated approach saves investors time and effort and ensures that the bond ladder strategy is executed efficiently and effectively.

Key Features

Automation and Convenience:

Wealthfront’s Automated Bond Ladder streamlines the entire bond management process, covering everything from bond selection to reinvesting proceeds. This innovative automation system optimizes your investments and relieves you of the need for constant oversight.

By leveraging advanced algorithms and market insights, Wealthfront’s Automated Bond Ladder helps you build a diversified bond portfolio tailored to your financial goals and risk tolerance.

This hands-off approach allows you to confidently grow your wealth while minimizing the time and effort required for bond management.

Higher Yield Potential:

The bond ladder strategy can offer higher yields than traditional savings accounts or CDs. By diversifying various maturities, you can capture better interest rates over time.

This strategy involves investing in a series of bonds with staggered maturity dates, which can help spread interest rate risk and provide a steady income stream.

Additionally, by reinvesting the proceeds from maturing bonds into new ones, you can take advantage of changing interest rates and potentially boost overall returns.

Risk Management:

Bonds are often considered safer investment options than stocks due to their fixed interest payments and lower volatility. Wealthfront’s investment approach focuses on creating a well-diversified bond portfolio, which helps mitigate the risks of investing in a single bond or bond type.

This diversified approach can provide more stability and a reliable income stream, making it an attractive option for risk-averse investors.

Accessibility and Liquidity:

While bonds typically require a long-term commitment, Wealthfront’s platform provides liquidity by allowing you to sell bonds as needed, although early sales might affect returns.

This feature offers flexibility and access to funds when necessary, but before opting for early sales, it’s essential to consider the potential impact on investment returns.

Who Should Consider This Product?

The Automated Bond Ladder is a strategic investment approach well-suited for conservative investors who want to diversify their portfolios with fixed-income securities.

This method is particularly beneficial for individuals nearing retirement or those seeking a reliable income stream without being subject to the stock market’s volatility.

By automating the process of regularly purchasing bonds with staggered maturity dates, investors can potentially benefit from a steady income stream while spreading out interest rate risk.

This approach can provide security and stability, making it an attractive option for those looking for a more predictable investment strategy.

Financial Impact and Benefits

- Steady Income Stream: The laddering strategy ensures that you receive regular interest payments, which can be a crucial component of a balanced investment portfolio.

- Diversification: By including bonds with different maturity dates and issuers, you spread your risk, enhancing overall financial stability.

- Effortless Management: Wealthfront’s automation removes the complexity of bond investing, making it accessible even for those with limited financial knowledge.

A Comparative Edge

Compared to traditional 5-year CDs, Wealthfront’s Automated Bond Ladder could provide better returns with similar or lower risk. CDs often lock your money for the entire term, while bond ladders offer flexibility and potentially higher yields due to varying interest rates over time.

Wealthfront’s Automated Bond Ladder spreads your investment across a series of bonds with staggered maturity dates, allowing for regular income and increased returns as interest rates change.

This strategy can help mitigate interest rate risk and provide more liquidity than locking your funds into a single long-term CD.

Considerations and Drawbacks

- Market Risk: While bonds are safer than stocks, they are not entirely risk-free. Interest rate fluctuations can impact bond prices and yields.

- Fees: Evaluate Wealthfront’s fees to ensure they don’t significantly erode your returns.

- Liquidity Needs: Assess your need for cash flow and whether bonds maturing at different times align with your financial goals.

Conclusion

Wealthfront’s Automated Bond Ladder is a compelling option for those seeking a low-risk, hands-off investment strategy that offers steady returns and liquidity.

By leveraging Wealthfront’s expertise and automation, you can enjoy the benefits of bond investing without the complexities. This innovative product deserves serious consideration to enhance your portfolio with a reliable income stream.

Ready to take advantage of Wealthfront’s innovative Automated Bond Ladder?

Start building your low-risk, high-yield portfolio today and enjoy the benefits of automated investment management. Open an Account with Wealthfront Now and secure your financial future with ease!

Leave a Reply